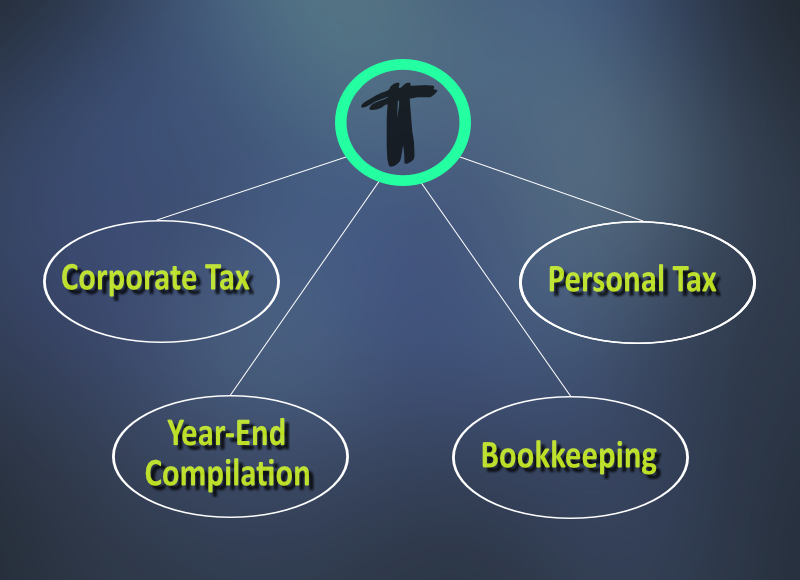

Truong Tax and Accounting Services Ltd. provides cost-efficient and timely tax and accounting services to incorporated small businesses, small business owners and individuals.

Preparing tax returns can be complex, as corporate and personal tax rules are constantly changing.

Tax planning should complement with tax preparation; stay current with tax rules should complement with tax planning. Tax planning is about looking into the future and proactively implementing strategies to minimize tax. On the other hand, tax preparation is about looking into the past and reactively putting numbers into tax software in order to file the tax return.

Compilation engagement is the most cost-effective for incorporated small business for compiling year-end financial statements and filing corporate tax return.

Understanding financial statements is very important for business owners; its function as a roadmap to help you steer your business in the right direction. Financial statements show where your business stands and how your business has performed over time. Also, financial statements are very useful tool for analyzing your business and identifying areas requiring improvement.